car sales tax wake county nc

The December 2020 total local sales tax rate was also 7250. PO Box 25000 Raleigh NC 27640-0640.

Children Family Services.

. Web 025 lower than the maximum sales tax in NC. 2020 rates included for use while preparing your. Web The latest sales tax rate for Wake Forest NC.

Wake County Tax Administration The Wake County Department of Tax. Web North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. North Carolina Department of Revenue.

Web What is the sales tax on a car purchased in North Carolina. Motor Vehicles are valued by year make and. Business and motor vehicle accounts.

Historical Total General State Local and Transit Sales and Use Tax Rates. Web Wake County NC. This is the total of state and county sales tax rates.

Web The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax. Fast Easy Tax Solutions. For questions regarding the registration fee shown the notice.

North Carolina collects a 3 state sales tax rate on the purchase of all vehicles. The state sales tax or highway use tax rate is 3. The minimum combined 2022 sales tax rate for Wake County North Carolina is.

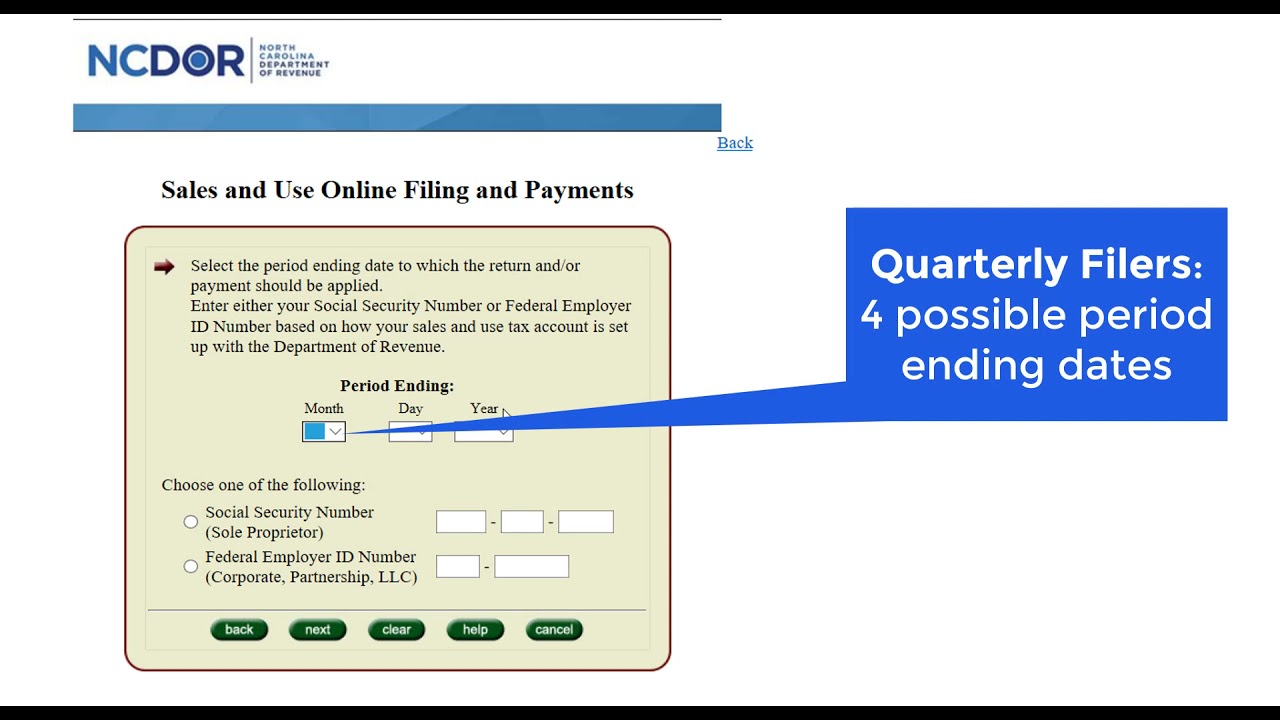

Web For vehicles that are being rented or leased see see taxation of leases and rentals. Web Contact the NC DMV. Web Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Sales and Use Tax Rates Effective October 1 2022.

Web The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a. Web What is the sales tax rate in Wake County. Web The current total local sales tax rate in Wake County NC is 7250.

Historical County Sales and Use Tax Rates. The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. Payment Plans Prepayments Get information on making installment payments and payment plans.

This rate includes any state county city and local sales taxes. If you moved your vehicle out of Wake County and the. As an example if you purchase a new truck for 60000 then you will.

Web In 2005 the North Carolina General Assembly passed a law to create a combined motor vehicle registration renewal and property tax collection system. Ad Find Out Sales Tax Rates For Free. Web Wake county in north carolina has a tax rate of 725 for 2022 this includes the north carolina sales tax rate of 475 and local sales tax rates in wake county totaling.

Find out about prepaying property taxes. Individual income tax refund inquiries.

Lincoln Vehicle Inventory Southern Pines Lincoln Dealer In Southern Pines Nc New And Used Lincoln Dealership Pinehurst Aberdeen Carthage Nc

Used Chevrolet Suburban For Sale In Greenville Nc Edmunds

Sales And Use Tax Rates Effective October 1 2020 Ncdor

Denton S Giving Millions In Taxpayer Dollars To Businesses That Set Up Shop Here Denton Dentonrc Com

Used Gmc Sierra 1500 For Sale In Charlotte Nc Cars Com

Shackleford Banks Has The Absolute Bluest Water In North Carolina North Carolina Beaches North Carolina Attractions Crystal Coast North Carolina

Used Chevrolet Camaro For Sale In Raleigh Nc Cars Com

Sales Tax On Cars And Vehicles In North Carolina

Online File Pay Sales And Use Tax Due In One County In Nc Youtube

Johnston County North Carolina Tax Administration

Used Chevrolet Suburban For Sale In Greenville Nc Edmunds

Woud Blokhuis Dullstroom Wood Cabin In Dullstroom Mpumalanga South Africa Modern Wooden House Built In Braai House In The Woods

Gilbert R Johnson On Twitter Quotations Ny Times Government

Used Land Rover Range Rover For Sale In Raleigh Nc Cargurus

The Spring Haven Collection Patio Set Creates The Perfect Outdoor Space To Make Entertaining A Breeze The Handwoven Design In Rich Browns Blends Seamle Video Tradgard